Oldsmobile for Sale

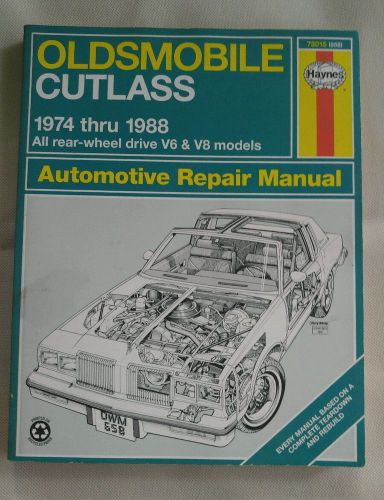

Haynes oldsmobile cutlass 74-88 all rear-wheel drive v6 & v8 models manual(US $18.99)

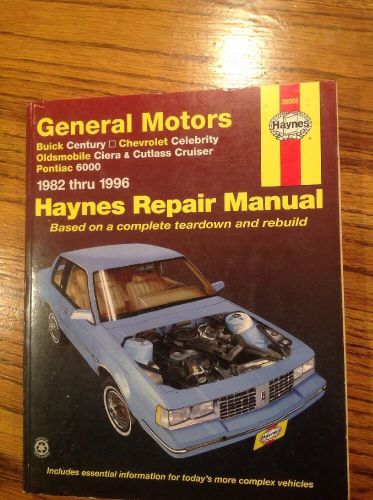

Haynes oldsmobile cutlass 74-88 all rear-wheel drive v6 & v8 models manual(US $18.99) Repair manual haynes 38005(US $5.95)

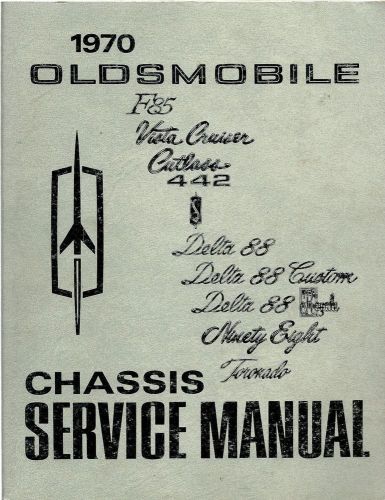

Repair manual haynes 38005(US $5.95) Oldsmobile chassis service manual 1970, clean original(US $34.95)

Oldsmobile chassis service manual 1970, clean original(US $34.95) 1992 oldsmobile ninety eight oem owner's manual.(US $23.50)

1992 oldsmobile ninety eight oem owner's manual.(US $23.50) 1999 olsmobile intrigue oem factory dealer service shop repair manual 3 vol set(US $49.99)

1999 olsmobile intrigue oem factory dealer service shop repair manual 3 vol set(US $49.99) 1961 oldsmobile 88 s88 98 oldsmobile service oem shop manual(US $18.95)

1961 oldsmobile 88 s88 98 oldsmobile service oem shop manual(US $18.95)

Porsche to produce Boxster S Black Edition

Wed, 02 Feb 2011The new 2012 Porsche Boxster S Black Edition will be available this spring, the automaker said Wednesday. The Black Edition is powered by the same 3.4-liter six-cylinder engine found in the Boxster S. But the Black Edition produces 320 hp, 10 more than the Boxster S.

Audi Urban Concept again, this time with photos and detail

Mon, 12 Sep 2011Audi Urban Concept EV- just a posh toy car It looks like we may have to dub the 2011 Frankfurt Motor Show the EV Go-Kart show, such is the proliferation of fun – if ultimately rather pointless – electric go-karts. And today, just ahead of its debut, we get real photos and decent detail on the Audi Urban Concept EV. We’ve had the teasers for the Audi Urban Concept and a set of CGI images a few weeks ago, but now we get photos of the real car (is car the right word?) and some detail about its powertrain and abilities.

McLaren MP4-12C performance specs released

Sun, 13 Feb 2011The twin-turbo, 3.8-liter V8 in the McLaren MP4-12C sports car cranks out 592 hp at 7,000 rpm, according to factory performance specs released on Sunday. The engine hits its torque peak of 443 lb-ft at 3,000 rpm and holds it up to 7,000 rpm. That power gives the MP4-12C a top speed of 205 mph.