Piper Arrow Pa28-180 Main Gear Actuator P/n Sfa-232-3 on 2040-parts.com

Davenport, Florida, United States

Parts for Sale

Piper pa-34-200 1973 seneca 1 nose landing gear trunnion p/n: 95723-00 (15826)(US $394.49)

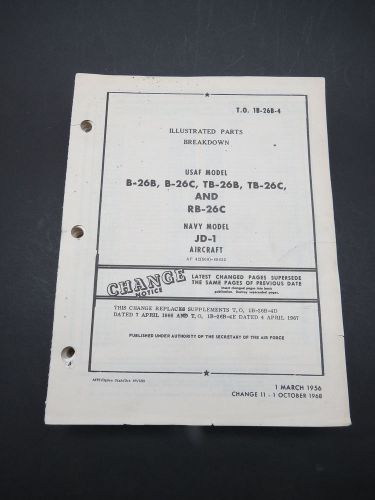

Piper pa-34-200 1973 seneca 1 nose landing gear trunnion p/n: 95723-00 (15826)(US $394.49) Original 1956-1968 douglas b-26 jd-1 invader 678pg illustrated parts manual

Original 1956-1968 douglas b-26 jd-1 invader 678pg illustrated parts manual New old stock continental o470, o520 valve cover, 625615 most likely pn(US $36.00)

New old stock continental o470, o520 valve cover, 625615 most likely pn(US $36.00) Wood electric circuit breakers 10 amps 454 669 435 210 103 guaranteed(US $10.99)

Wood electric circuit breakers 10 amps 454 669 435 210 103 guaranteed(US $10.99) Piper j3 cub, pa11 pa18 landing gear legs tubes landing gears package deal!(US $199.00)

Piper j3 cub, pa11 pa18 landing gear legs tubes landing gears package deal!(US $199.00) Piper pa-28 speed modification cherokee arrow set of flap hinge covers fairings(US $74.95)

Piper pa-28 speed modification cherokee arrow set of flap hinge covers fairings(US $74.95)

Jaguar Land Rover raise £500 million to fund expansion

Fri, 23 Mar 2012Jaguar Land Rover raise £500 million Jaguar Land Rover is raising £500 million on the bond market to fund its expansion, including new models and new facilities. Hot on the heels of the Jaguar Land Rover joint venture deal with Chery in China comes the news that Jaguar has dipped in to the private bond market to raise £500 million to help with its bold and bullish plans to make JLR a major world player in the premium vehicle sector. JLR plans to invest £1.5 billion a year on expansion and is making sure its coffers can cope by issuing £500 million of senior notes due in 2020, with the net proceeds of the bonds being used for general corporate purposes.

Change afoot at Saab as CEO retires: where next?

Mon, 28 Mar 2011Click here to see all 2011 Saab articles Saab CEO Jan Åke Jonsson announced his retirement on Friday. It was yet another small but significant news nugget from Saab – the inbox has buzzed with announcements ever since the bankrupt car maker was saved by an independent takeover on 23 February 2010. The news that Saab's veteran CEO is stepping down makes us wonder what life's really like under the bravado of Europe's newest independent car maker.

Sources: GM in talks with two potential buyers of Hummer

Thu, 12 Feb 2009General Motors is in talks with two potential buyers of its Hummer brand as the automaker continues to sell assets to raise cash, said two sources familiar with the matter. The negotiations are with a private-equity firm and a Chinese company, said the sources, who declined to be named. The sources declined to name the potential buyers because the effort is private.